Protecting Shareholder Capitalism from Leftist Social Engineers

“Bottom line: it is not the role of passive index-fund managers to advance social or political policy, liberal or conservative. To function as they should, the financial markets must be a transparent, honest, level playing field focused on investor returns.”

This essay first appeared on Law & Liberty on January 29, 2025 (here). Thanks to Real Clear Markets (here), Real Clear Books & Culture (here), the Society for Corporate Governance (here), Ace of Spades HQ (here), and the Michael Patrick Leahy Show.

The politicization of corporate governance (and, derivatively, of the capital markets themselves) is a complicated subject. Treatments of the topic tend to be either eye-glazingly technical or disappointingly superficial. For that reason, the origins and significance of “stakeholder capitalism,” ESG (referring to the woke investment policy of “environmental, social, and governance”), “sustainability,” and similar activist strategies remain poorly understood by the average citizen—even though most Americans have an ownership interest in the stock market through their 401(k) accounts or personal investments.

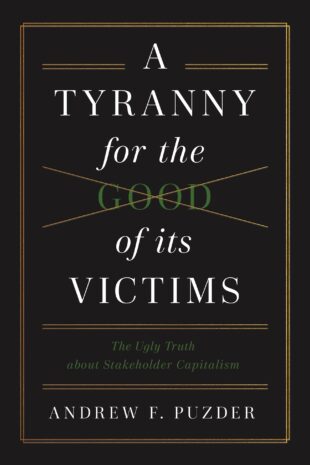

Few people are better equipped to explain these issues than Andrew Puzder, an accomplished litigator, former CEO of a publicly-traded company (CKE Restaurants, Inc., which operates the chains Carl’s Jr. and Hardee’s), a frequent speaker and commentator, and author of two prior books on economic and business issues. Puzder was also nominated to serve as Secretary of Labor in the first Trump administration; he withdrew amid controversy over his opposition to raising the federal minimum wage and other issues. Puzder is a longstanding critic of the ESG agenda, and a leader in the anti-ESG movement, which he dubs “the Resistance.”

Puzder’s latest book, A Tyranny for the Good of Its Victims: The Ugly Truth about Stakeholder Capitalism, is a highly-readable, informative, and pungent broadside against what he calls “socialism in sheep’s clothing”—a social-justice, radical-environmentalist agenda devised by elites using ever-changing euphemisms and saccharin acronyms to supplant free-market capitalism. The “victims” referred to in the title are ordinary Americans, whom Puzder argues are being deceived by a cadre of powerful insiders with the goal of “allowing massive investment firms to implement collectivist ESG policies that lack popular support.” Puzder is unabashedly opinionated, and forcefully argues his case like the seasoned trial attorney that he is. His philosophical lodestars are freedom and free-market principles. (The book is dedicated “to the memory of Milton Friedman.”)

Puzder is a passionate champion of capitalism, which he celebrates (at chapter length) as “an economic miracle.” His primary concern about “stakeholder capitalism” is that it subverts the checks-and-balances of the free market, and therefore alters the desired balance of the economic order, which in turn undermines the processes of democratic self-government. Puzder argues that “stakeholder capitalism” and the ESG agenda “threaten our democracy by creating a shortcut around the ballot box.” The purveyors of ESG, Puzder charges, “intend to use their power to supersede the will of the people,” because “they deem us incapable of governing ourselves.” A Tyranny for the Good of Its Victims is a bracing read, but the polemics come with receipts—facts supporting conventional economic theory. Puzder makes a convincing case that true shareholder democracy is in jeopardy.

Puzder’s premise—shared by Friedman–is that corporations are owned by, and exist for the benefit of, their shareholders. Accordingly, corporate officers owe a fiduciary duty—meaning undivided loyalty–to the shareholders. The goal of the corporation is to earn the maximum profits legally possible for the owners. Conversely, one of the essential attributes of ownership is the ability to direct the management of the corporation—by voting for candidates to the board of directors, participating in shareholder meetings, and so forth. Classical liberals refer to this model as “shareholder capitalism.” Ideally, Tocquevillian democracy exists in corporate governance as well as civic affairs.

So-called “stakeholder capitalism” turns this concept on its head. The premise of “stakeholder capitalism” is that corporations owe a duty to all affected interests: employees, consumers, suppliers, future generations, the environment, the climate, “human rights,” the global community, etc. All of society, in other words. Woke elites unilaterally dictate what policies are suitable for these non-investor “stakeholders,” despite the absence of popular support, and even if the policies are contrary to the interests of the actual owners. This is how “social justice” goals such as ESG, “sustainability,” forced diversity on corporate boards, workforce quotas, equity, “decarbonization,” and other fads replace fealty to the shareholders. Puzder scorns this agenda as “a champagne socialism that would devastate the world’s poor and impoverish the working and middle classes globally.”

In most cases, the pursuit of woke corporate policies comes at the expense of profitability, thereby harming the shareholders. Accountability for this betrayal is rare. In a refreshing departure from this trend, a federal court in Texas recently held that American Airlines violated its fiduciary duty to shareholders (in that case, a class of more than 100,000 participants in the company’s 401(k) plan) by embracing ESG objectives in lieu of maximizing shareholder value. Instead, the court found that American Airlines had allowed an investment firm, BlackRock, to dictate corporate policy, to the detriment of the company’s retirement plan participants.

How exactly did BlackRock and other firms manage to usurp the interests of individual shareholders? This is the focus of Puzder’s book. He explains how a handful of investment firms—notably BlackRock, State Street, and Vanguard, which Puzder terms the “Big Three”—are able to exert such enormous influence over America’s corporations. The answer is deceptively simple: the ubiquity of index funds as a vehicle for individual investors to participate in the stock market.

Until fairly recently, if an individual wished to invest in stocks, he would have to purchase shares through a stock broker, with the resulting commissions. The shares would be held in the individual’s name, but the process was cumbersome and—until the advent of discount brokers—expensive. Then came the managed mutual fund, a basket of stocks chosen by the fund manager in which individuals could purchase an interest. This type of mutual fund reduced transaction costs and improved diversification, but still entailed the expense of an active manager researching stocks and adjusting the portfolio. And, with a few exceptions, managed mutual funds still generally under-performed the market as a whole.

Jack Bogle, founder of Vanguard, revolutionized investing by popularizing commission-free “index” funds that consist of a cross-section of an entire industry segment or even the stock market as a whole. Index funds provide diversification and reduced expenses because the manager is “passive.” Index funds have grown exponentially in the past decade and now dominate the stock market. Puzder contends that the Big Three represent “the most powerful financial-markets cartel in U.S. history.” Although the individuals owning shares of an index fund are the beneficial owners of the underlying stocks, the fund managers are the technical owners able to vote for board members, participate in proxy voting, and the like. Index fund investors have no voice in corporate governance.

When it comes to corporate activism, the Big Three are anything but passive. For example, BlackRock CEO Larry Fink is a leading proponent of “stakeholder capitalism” and ESG. State Street and Vanguard follow suit.

The irony is that index funds rely on fees charged to investors rather than corporate profits for their revenues. Thus, the Big Three are playing social engineer with other people’s money. As Puzder notes, “the investors who trusted those firms to invest their monies prudently to maximize returns end up paying ESG’s costs. Those costs are a social-agenda tax for which no one voted—and of which few are aware.” Puzder argues that “The great financial innovation of passive index investing was never supposed to entail power brokers co-opting their shareholders’ rights with such a governance grab, enabling them to impose their will on American businesses.” Puzder makes this point convincingly, backed by facts, studies, and footnotes.

He provides many detailed case studies of ESG policy failures, including the now-familiar collapse of Silicon Valley Bank, whose “diverse” board was inept and steered the bank to ruin. Puzder also explores Boeing’s disastrous missteps, which coincide with its embrace of an “equity” agenda. Merit is the driving force for a successful business; without it, a company is doomed. DEI, enthusiastically advocated by the Big Three, is toxic and typically detrimental to profitability. Puzder excoriates DEI as “a cover for racializing the hiring process and pushing racial and sexual equity and the queer/trans LGBTQIA+ agenda in the public square.” Puzder is particularly perturbed by baseless environmental activism in the name of fighting “climate change.”

For example, in 2021, the Big Three backed a successful campaign led by radical environmentalists to force Exxon, America’s largest energy producer, to “go green”—that is, achieve net-zero emissions from fossil fuels—by 2050. This was accomplished by electing a slate of net-zero zealots to Exxon’s board of directors (over management’s objections), thereby forcing Exxon to reduce oil production. Exxon is in the business of oil production. This is like forcing McDonald’s to go vegan, or telling Big Pharma to go holistic, or making Big Tech forgo electricity. Such “stakeholder” activism—an attack on corporate profitability–is contrary to the financial interests of the corporation’s shareholders, and not the proper role of a passive index fund.

What is the solution? This is the heart of the book, and Puzder’s insider perspective is unsurpassed. The first step is increasing public awareness and educating elected officials and investors about the extent of the problem—efforts that have been underway for a few years and begun to bear fruit. Since a “wake-up call” in 2019, when the influential Business Roundtable alarmingly endorsed “stakeholder capitalism,” a resistance movement—in which Puzder played a leading role–formed to oppose the activist agenda. The Resistance (as Puzder calls it) attracted the attention of red state governors and legislators, and conservative organizations such as the Heritage Foundation and the American Legislative Exchange Council. The tide began to turn. The Big Three’s momentum has been slowed, but not completely halted.

Puzder identifies several specific strategies for opposing “stakeholder capitalism,” including litigation similar to the American Airlines case mentioned above, by shareholders against corporations, and by index fund investors against the Big Three, for breach of fiduciary duty. An investment manager advocating policies contrary to shareholder returns should be actionable. Such litigation would be boosted by reinstating the fiduciary duty standard under ERISA (the federal law regulating pension plans) enacted in 2021 during Trump’s first term, which was ignored and then rescinded by President Biden.

Because the ESG agenda hinders financial returns, red states can withdraw state employee retirement funds from managers who engage in social engineering at the expense of shareholder performance. Oil-producing states such as Texas can—and do–refuse to do business with firms (such as BlackRock) who embrace net-zero mandates. Likewise, red states can pass legislation defining “stakeholder capitalism” as a breach of fiduciary duty under state law for public (government-run) pension funds, which are exempted from ERISA. Coordinated action by woke investment managers to coerce corporations to comply with their policy demand may violate the antitrust laws and result in lawsuits. The Supreme Court’s 2023 decision in Students for Fair Admissions v. Harvard raises potential legal challenges to the advocacy of forced board diversity and workforce quotas.

Puzder discusses these (and other) options in great detail.

Because ESG and “stakeholder capitalism”—social activism masquerading as business–demonstrably underperform actual capitalism, the woke proponents of such schemes are vulnerable to class action claims and other forms of legal redress by shortchanged shareholders. The application of pressure—via PR, litigation, legislation, and regulation—has slowed the ESG agenda. ESG proponents have abandoned the label but continue to pursue radical objectives in the name of combatting “climate change,” using new euphemisms, such as “decarbonization” and “climate risk.” The world cannot function without fossil fuels, and it is reckless to force companies to switch to unproven and unworkable alternatives. Puzder charges that this is “a politically motivated move to bring about a result the progressive elites have determined in our ‘long-term’ interest, whether we want it or not.”

With continued resolve, the Resistance may eventually vanquish altogether the index-fund activists who tried to hijack corporate governance to implement a controversial agenda they could never impose through the political process. As Puzder notes, the struggle is not over: “Only a sustained effort…will topple the stakeholder capitalists’ house of cards.” In the meantime, Puzder deserves great credit for his role in the Resistance, and his commendable book is a road map (and a motivational exhortation) for total victory.

Milton Friedman would surely approve.